Learn how to build a pricing model with our guide. We cover data gathering, choosing a strategy, and using tools to refine and automate for real revenue growth.

December 21, 2025 (2mo ago)

How to Build a Pricing Model That Drives Profitability

Learn how to build a pricing model with our guide. We cover data gathering, choosing a strategy, and using tools to refine and automate for real revenue growth.

← Back to blog

Title: How to Build a Pricing Model That Drives Profitability

Summary: Learn how to build a pricing model with our guide. We cover data gathering, choosing a strategy, and using tools to refine and automate for real revenue growth.

Introduction: Learn how to build a pricing model with our guide. We cover data gathering, choosing a strategy, and using tools to refine and automate for real revenue growth.

Tags: how to build a pricing model, pricing strategy, pricing models, value based pricing, revenue optimization

Content: A pricing model is a whole lot more than just a price tag; it’s the engine that connects the value you provide to the revenue you generate. Think of it as a repeatable, data-driven system for figuring out how much to charge. When you get it right, pricing stops being a gut-feel decision and becomes one of your most powerful strategic assets.1

A Practical Blueprint For Your Pricing Model

Let’s be honest, building a pricing model from scratch can feel daunting. It’s not about pulling a number out of thin air. It’s about creating a structure that actually drives growth and profitability. The best models create a clear, logical link between the price a customer pays and the value they get, which is the foundation for building long-term loyalty and protecting your margins.

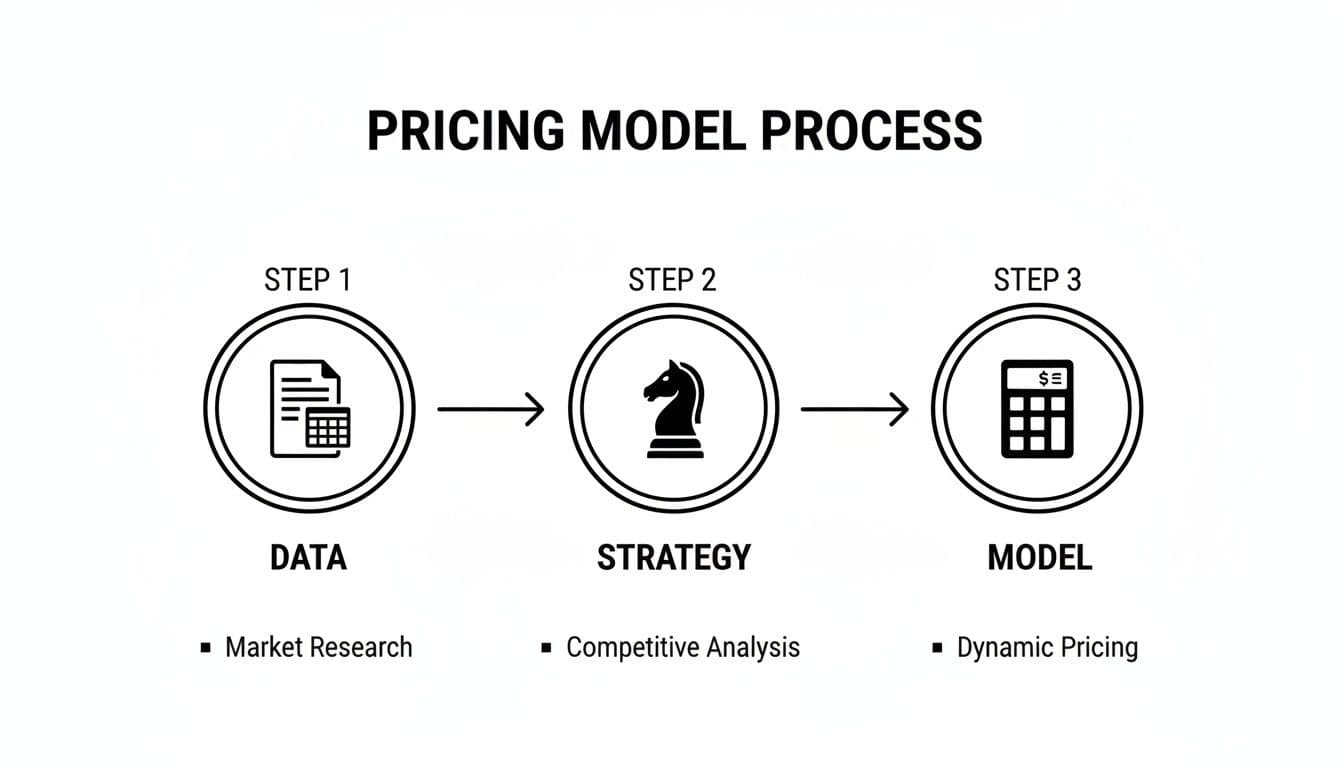

The whole process boils down to a few core stages, moving from foundational research to hands-on implementation.

- Gather Your Inputs: First, you need a crystal-clear picture of your internal costs—both fixed and variable. You also have to size up the competition and, most critically, get inside your customers’ heads to understand what they truly value.

- Define Your Strategy: Once you have the data, you can pick a pricing structure that fits. Will it be a straightforward cost-plus model, or a more sophisticated value-based or tiered approach? The answer depends entirely on your business goals and customer segments.

- Build the Mechanics: This is where you bring it all to life. You’ll translate your data and strategy into a working financial model that lets you calculate prices, run what-if scenarios, and see how different decisions could impact your bottom line.

This flow is a simple but powerful way to think about it—your Data informs your Strategy, and your Strategy dictates your Model.

Following these stages ensures your model is built on solid ground, not just a hunch.

From Core Components To A Working Model

To make this even more tangible, every effective pricing model relies on a few key inputs and outputs. Understanding these pieces is the first step in building something that works in the real world.

Core Components of a Pricing Model

| Component | Description | Example |

|---|---|---|

| Cost Inputs | All direct and indirect expenses required to deliver your product or service. | Software subscriptions, employee salaries, office rent, marketing spend. |

| Value Metrics | The specific unit of value your customer receives and is willing to pay for. | Per user, per GB of storage, per project, per hour of service. |

| Pricing Structure | The framework you use to charge for your value metrics. | Flat-rate monthly subscription, tiered plans (Basic, Pro), usage-based billing. |

| Calculations | The formulas that combine costs, value metrics, and structure to produce a final price. | (Cost of Goods Sold / (1 - Gross Margin %)) = Price |

| Scenario Analysis | The ability to model different assumptions to see the impact on revenue and profit. | “What happens to our LTV if we increase prices by 10% and churn increases by 2%?” |

| Final Outputs | The clear, actionable pricing presented to the customer and key business metrics. | A public pricing page, a quote generator, projected Annual Recurring Revenue (ARR). |

With these components defined, you have the raw materials to construct a model that’s both strategic and functional.

Turning Theory Into A Revenue-Generating Tool

This guide is designed to get you past the theory. We’ll skip the academic jargon and focus on what actually works, showing you how to select the right structure and use modern tools to make your pricing dynamic and effective. The goal is to evolve your pricing from a static number into an interactive asset that works for you.

For instance, a marketing agency could embed an interactive ROI calculator on its website. This doesn’t just give potential clients an immediate “aha!” moment; it also captures highly qualified leads, transforming a simple pricing tool into a powerful sales engine. A solid pricing model is fundamental, and you can find complementary tools such as the Facebook Ads Cost Estimator and the Email List Value Estimator to help quantify campaign impact.

“When you build interactive tools, you empower customers with self-service options. This builds trust and, just as importantly, frees up your sales team from repetitive quoting to focus on closing complex, high-value deals.”

Gathering Your Essential Pricing Data

Before you can even think about building a pricing model, you need to gather your raw materials. And in this case, those materials are data—solid, reliable data. Trying to set prices without it is like building a house on sand; it’s just not going to hold up.

This whole process starts by looking inward at your own numbers.

Start with Your Internal Costs

You absolutely have to know what it costs you to deliver your product or service. And I’m not just talking about the obvious stuff like raw materials. You need the full financial picture.

This means calculating your fully burdened costs, which is a fancy way of saying “everything.” This includes:

- Variable Costs: Things that change with how much you produce, like materials or shipping.

- Fixed Costs: The consistent bills that show up no matter what, like rent, insurance, and those monthly software licenses.

- Labor Costs: This is so much more than just a salary. You have to factor in benefits, taxes, and other overhead. Understanding your fully burdened labor rate is non-negotiable for any service business.

- Customer Acquisition Cost (CAC): How much do you spend on sales and marketing to land one new customer? If it costs you $500 to get someone in the door, your price needs to reflect that.

Getting this wrong is one of the fastest ways to run an unprofitable business, even if sales are booming. This is the first, non-negotiable step.

Analyze the Competitive Landscape

Once you’ve got your internal costs figured out, it’s time to look outside your own four walls. You don’t operate in a vacuum. Your customers will absolutely judge your prices against the other options out there. The goal isn’t to copy your competitors, but to understand what the market generally accepts as a reasonable price range.

Start by asking some key questions:

- What are direct competitors charging for something similar?

- How do they structure their prices? Are they using tiers, charging by usage, or something else?

- Where do you fit in? Are you the premium option, the budget-friendly choice, or the best value for the money?

This kind of market intelligence gives you crucial context. For instance, if your costs force you to price 30% higher than the market leader, you’d better have a very compelling story about why you’re worth it.

Historical data is a goldmine here. Retailers use it to spot seasonal trends and tech firms use it to stage launch pricing and planned declines. This historical perspective helps you build a model that can adapt.

“A classic mistake is letting your competitors dictate your pricing. Use their numbers as a data point, not a directive. Your price should be a confident statement about your own value.”

Quantify Your Customer Value

This is easily the most overlooked piece of the puzzle, but it’s arguably the most important. At the end of the day, customers don’t buy features; they buy outcomes. The value you provide is the real or perceived impact your solution has on their business or life.

If you can put a number on that value, you’ve unlocked the secret to premium pricing.

Instead of just listing what your product does, translate those features into tangible benefits. For a B2B software, that might be “saves 10 hours of manual work per week” or “reduces compliance risk by 50%.” For a B2C product, it could be convenience, status, or just good old-fashioned peace of mind.

To make this practical, let’s take a service business as an example. Instead of just pulling an hourly rate out of thin air, you could use a tool to factor in your actual costs, your profit goals, and your total billable hours. Tools such as the Consulting Rates Estimator can help freelancers and small firms build data-backed hourly fees.

It’s about bridging the gap between your costs and the tangible value you deliver, which creates the solid foundation your entire pricing model will rest on.

Choosing the Right Pricing Strategy

Now that you have your cost, market, and value data in hand, it’s time to decide on the architectural frame for your pricing model. This is where strategy meets structure.

There’s no magic bullet here. The “best” choice is completely dependent on your industry, your product, and, most importantly, who you’re selling to. Think of it like choosing the foundation for a house—the one you pick has to support everything you build on top of it.

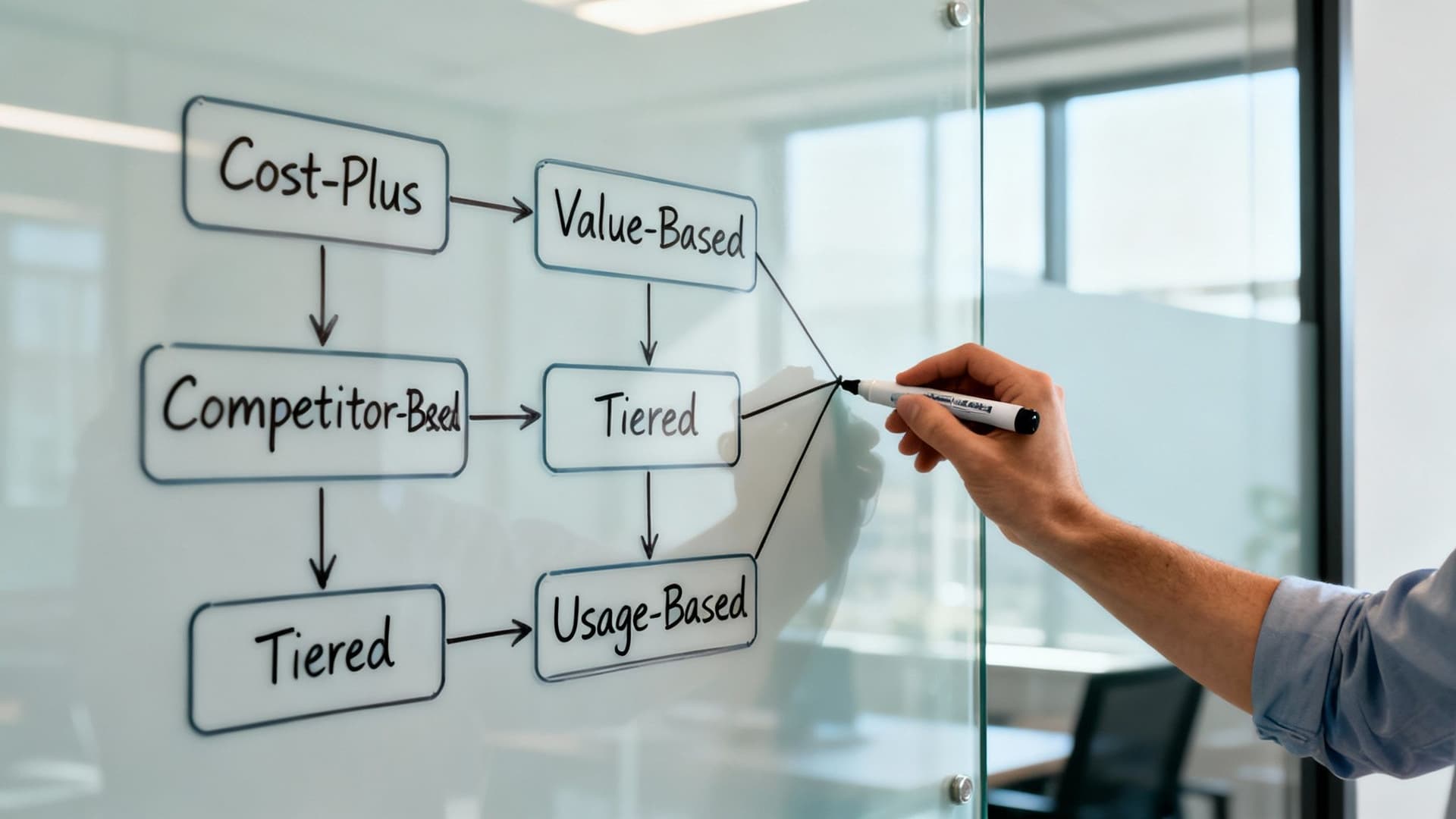

Cost-Plus and Competitor-Based Pricing

Cost-Plus Pricing is about as straightforward as it gets. You just calculate all your costs to produce and sell a product, then tack on a percentage markup for profit. It’s simple, easy to calculate, and guarantees you cover your expenses, which is why it’s a go-to in manufacturing and retail.

The big drawback? It’s an inside-out approach that completely ignores your customers and the competition. You could be leaving a ton of money on the table if customers would happily pay more, or you might price yourself right out of the market.

Competitor-Based Pricing, on the other hand, uses the market landscape as its primary guide. You set your prices based on what your direct competitors are charging. This is common in crowded markets where products are nearly identical, but it’s a risky game to play. It can easily trigger a “race to the bottom,” where everyone competes on price until margins are destroyed.

Cost-plus tells you what you should charge to stay profitable. Competitor pricing tells you what you could charge to stay competitive. Neither tells you what you can charge based on the unique value you deliver.

Value-Based and Modern Service Models

Value-Based Pricing flips the script entirely. Instead of starting with your costs, you start with the customer. The price is anchored to the real, tangible value your product delivers. For any innovative product or service that provides a clear, quantifiable ROI, this is the gold standard.

Think about it: if your software saves a client $10,000 a year in labor costs, charging $2,000 suddenly feels like a bargain. This approach disconnects your price from your internal costs and ties it directly to customer success—a far more powerful and profitable position to be in.2

This philosophy aligns perfectly with modern business models:

- Tiered Pricing: Multiple packages (Basic, Pro, Enterprise) with different features at different price points.

- Usage-Based Pricing: The customer pays only for what they consume—per gigabyte of data, per API call, or per transaction.

Pricing theory has evolved dramatically with cloud and data-driven services. From fixed-price retail to dynamic surge pricing, history shows a clear trend toward more granular, data-informed models.

Ultimately, choosing the right strategy is a balance. You can’t ignore your costs or your competition, but your primary focus should always land on the value you create for your customers.

For a deeper dive, consider tools that help quantify outcomes such as the Business Valuation Estimator when assessing long-term client value.

Building and Testing Your Financial Model

You’ve done the homework—gathered the data and picked a pricing strategy. Now it’s time to get your hands dirty and actually build the financial model. This is where your strategy moves from a whiteboard concept to a concrete, working tool.

For most people, this process starts in a spreadsheet. It’s familiar, flexible, and perfect for getting the basic mechanics down. You’ll create dedicated inputs for all your key data points: fixed and variable costs, the value metrics you’re charging for, and those competitor price points you need to keep in mind.

With your inputs ready, you’ll start building the formulas that tie everything together. This is the core engine of your model, the logic that translates your chosen strategy—be it cost-plus, value-based, or tiered—into a price you can actually charge.

Stress-Testing Your Assumptions

A pricing model that only works in a perfect world is set up to fail. Reality is messy, and your model needs to be tough enough to handle it. That’s where sensitivity analysis comes in—it’s your best friend for finding the weak spots.

Start asking “what if” and build those scenarios right into your spreadsheet:

- What happens to our gross margin if a key material cost suddenly jumps by 15%?

- How does a 5% drop in our lead-to-customer conversion rate hit our Customer Acquisition Cost (CAC) and overall profit?

- If we switch to new software that adds $2,000 a month in fixed costs, what’s our new break-even point?

If you need a refresher on break-even math, simple guides and calculators can walk you through the steps, or you can test scenarios using internal templates.

This process quickly shows you where your model is most vulnerable and which assumptions carry the most risk. A model that can survive these simulated shocks is one you can actually trust when the market throws you a curveball.

From Prototype to Real-World Validation

Once your spreadsheet prototype is working, it’s time to see if it holds up in the real world. A model is just a hypothesis until real customers have their say.

One of the best ways to do this is with A/B testing. You can show slightly different prices to different groups of visitors to see what happens. Maybe Group A sees a $49/month plan, while Group B sees $55/month. From there, you measure conversion rates, sign-ups, and revenue to find that sweet spot between willingness to pay and profitable margins.

Don’t forget the power of talking to people. Direct customer feedback through surveys and interviews gives you context that numbers alone can’t. Ask questions like, “At what price would this feel like a bargain?” or “At what price would it be so expensive you wouldn’t even consider it?” This qualitative feedback is gold.

It’s this blend of hard data from A/B tests and real stories from customers that turns your educated guess into a pricing structure you can confidently stand behind.

Turning Your Model into a Customer-Facing Asset

Spreadsheets are brilliant for internal work, but they quickly become a bottleneck if your sales team has to generate complex quotes. Manually crunching numbers is slow, error-prone, and adds unnecessary friction for potential customers.

This is where embedding an interactive calculator on your website can be a total game-changer. It takes your internal pricing logic and turns it into a dynamic, helpful tool for your visitors.

Think about a digital marketing agency. They could embed an estimator such as the Facebook Ads Cost Estimator so potential clients can estimate costs and ROI instantly. This transparency builds trust from the very first interaction and helps the client see exactly how fees translate into business growth.

This strategy does more than just speed up quoting; it becomes a powerful lead generation machine. By offering a genuinely useful tool, you capture contact info from highly qualified prospects who are already deep in the buying process. Similarly, a Business Valuation Estimator can attract owners thinking about long-term value, while the Consulting Rates Estimator helps independent consultants set competitive, profitable rates.

“By transforming your internal model into an interactive web tool, you shift from simply presenting a price to demonstrating value. This not only improves the customer experience but turns your pricing model into a proactive asset for growth.”

Implementing and Automating Your Pricing

A brilliant pricing model collecting dust in a spreadsheet is worthless. The magic happens when you actually implement it so it’s applied consistently with every single transaction.

For many B2B companies, this is the point where they graduate to a Configure-Price-Quote (CPQ) system. If you’re in e-commerce, it means diving into your platform’s pricing engine to set up the rules you’ve crafted.

The goal is to move beyond manual calculations and into a system that can scale. True implementation makes your pricing accessible and transparent, empowering customers instead of forcing them into long sales cycles just to get a basic quote.

From Manual Quoting to Self-Service Empowerment

What’s one of the biggest friction points in any sales process? The dreaded “Contact us for pricing” button. It’s an instant barrier, forcing a potential customer to wait for a sales call when all they want is an answer. Modern buyers expect instant gratification, and you can win a surprising amount of business simply by being more transparent than your competitors.

This is where self-service tools really shine. By embedding an interactive calculator or estimator directly on your website, you turn your internal pricing logic into a valuable, customer-facing asset.

A freelance web developer who’s swamped with quoting small projects could embed the Consulting Rates Estimator on their portfolio site, letting potential clients get instant ballpark estimates. This simple move saves hours of admin work, builds trust through transparency, and weeds out clients who aren’t serious.

“By providing instant answers, you’re not just offering a price; you’re delivering a superior customer experience. This slashes your administrative overhead and lets your sales team focus on high-value conversations instead of repetitive quoting tasks.”

The Strategic Benefits of Automated Pricing Tools

Automating your quoting process is more than an efficiency play; it’s a strategic move with serious upsides.

- Improved Lead Quality: Someone who uses your calculator isn’t a cold lead. They’re actively evaluating their needs and your solution, which makes them a much warmer prospect.

- Reduced Sales Cycle: Self-service tools answer the customer’s key question—“What will this cost me?”—instantly, shortening the path to purchase.

- SEO and Traffic Growth: Interactive tools often increase time on page and attract backlinks, both positive signals for search engines.3

- Competitive Differentiation: While competitors hide behind contact forms, you provide immediate value and transparency.

By turning your pricing model into an interactive experience, you transform it from a static internal document into a dynamic asset that actively works to win you new business.

Fine-Tuning Your Pricing Model: From Launch to Mastery

Launching your pricing model isn’t the finish line; it’s the starting gun. Pricing is a living part of your business. It has to adapt to market shifts, customer feedback, and your own changing goals. A “set it and forget it” approach is a surefire way to leave money on the table or, worse, become irrelevant.

Build a continuous feedback loop: measure, analyze, and tune your model based on real outcomes.

Track the right Key Performance Indicators (KPIs):

- Average Revenue Per User (ARPU): Tells you, on average, how much revenue each customer brings in.

- Customer Lifetime Value (LTV): Forecasts total revenue from a customer over their relationship with you.

- Customer Acquisition Cost (CAC): How much you spend to acquire a customer.

The real magic is in the ratios. Aim for an LTV:CAC of 3:1 or higher to ensure sustainable growth.

Turning Data into Action

Review these KPIs regularly. Did a 5% price increase cause your churn rate to spike? Did a new “Pro” tier boost ARPU without harming acquisition? The answers are in your data.

Pricing analytics helps you find your most profitable customer segments and features. For example, a company that tracks which leads use its interactive estimator may discover those leads convert at a much higher rate, allowing the business to focus marketing where it pays off most.

“Pricing isn’t a math problem with a single right answer. It’s an ongoing experiment where the goal is continuous improvement, not one-time perfection.”

The Power of Looking Back to Move Forward

Using historical data is a game-changer. SaaS companies often find the right number of tiers by reviewing customer behavior over time, while retailers use past demand to plan seasonal pricing.

This loop—measure, analyze, tune—is what separates businesses that just get by from those that consistently grow.

Answering Your Toughest Pricing Questions

Even the best-laid pricing plans run into real-world challenges. It’s one thing to build a model in a spreadsheet, but another to get it right in the wild. Here are answers to common practical questions.

How Often Should I Revisit My Pricing?

Think of pricing as a living thing. A full, deep-dive review is wise at least once a year, but monitor core KPIs monthly or quarterly. Revisit pricing immediately when:

- Your costs change materially.

- A major competitor makes a big pricing move.

- You launch a new product or major feature.

- Customer buying behavior shifts significantly.

What’s the Single Biggest Pricing Mistake People Make?

Tunnel vision. Focusing only on internal costs or competitor prices and forgetting the customer’s perspective is the fastest way to leave money on the table or destroy margins. Anchor pricing to the value you deliver rather than just to cost.

Can I Combine Different Pricing Models?

Yes. Hybrid models are common and effective—tiered subscriptions with usage-based add-ons, or fixed-price packages with custom quotes for complex work. The key is clarity: customers must easily understand what they’re paying for.

Quick Q&A: Common Pricing Questions

Q: What’s the first thing I should do when building a pricing model?

A: Start with fully burdened costs and Customer Acquisition Cost (CAC). If you don’t know your true costs, you can’t price for profit.

Q: How do I know if value-based pricing will work for my product?

A: If you can quantify the customer’s financial benefit or time saved, value-based pricing can often capture more profit than cost-plus approaches.

Q: What’s the simplest way to validate a new price?

A: Run an A/B test or pilot with a finite audience, track conversion and revenue, and collect direct customer feedback.

Ready to turn your pricing model into a powerful, interactive asset? Tools like the Business Valuation Estimator, the Consulting Rates Estimator, and the Facebook Ads Cost Estimator can help you quantify value and embed interactive experiences on your site.

Ready to Build Your Own Tools for Free?

Join hundreds of businesses already using custom estimation tools to increase profits and win more clients